Businesses under IGDS must file their GST returns on monthly basis. In above box you need to type discription of productservice or HS Code and a list of all products with codes and tax rates will be displayed.

Quotation Format In Excel Gst Quotation Format Quotation Template Word Quotations

If your business is registered for GST and youve reflected this in your GST settings youll use tax codes in MYOB to keep track of the tax youve paid and collectedEach tax code represents a particular type of tax.

. 31 Supplies SalesIncome - Summary of Transactions and GST Impacts The GST treatment GST Code will depend on the type of supply made as outlined below. Here you can search HS Code of all products we have curated list of available HS code with GST website. This rule came into effect on 1 April 2021.

Local purchases must be supported by valid tax invoices Imports must be supported by import permits The input tax is directly attributable to taxable supplies The input tax claims are not disallowed under Regulations 26 and 27 of the GST General Regulations. Gst pays an average hourly rate of 38 and hourly wages range from a low of 33 to a high of 44. Gst Hourly Pay Rate How much do Gst employees Hourly make in the United States.

To create a tax code. What Is GST. The GST rates are fixed under 5 slabs NIL.

If the recovery of expenses amounts to a supply it is subject to GST unless it qualifies as an exempt supply. Taxpayers will pay their GST through a simple challan. Accounting and bookkeeping services.

Accounting auditing and bookkeeping services. HS Code is internationally accepted format of coding to describe a product. It was first put in place in order to replace a number of indirect.

Goods and Services Tax GST. Individual pay rates will of course vary depending on the job department location as well as the individual skills and education of each employee. Go to the Lists menu and choose Tax Codes.

Goods and services tax GST is a broad-based tax of 10 on most goods services and other items sold or consumed in Australia. The recovery of expenses amounts to a supply unless the recovery is compensatory in nature and no goods or services are provided in return to the paying party. Taxpayers with a turnover of Rs5 crore and above will have to mention a 6-digit HSN code.

Lease or develop you may have to pay GST on the sale or lease of the property. The main taxes of the taxation code in Singapore are as follows. Some things dont have GST included these are called GST-free sales.

The income tax in Singapore is subdivided into the corporate income tax applicable for businesses and personal income tax for private persons. GST CODE REFERENCE GUIDE 2 13 Valid Tax Invoice To be a valid Tax Invoice the invoice must be issued by the supplier and contain the following information. The Tax Code Information window appears.

Under this tax slab 12 tax is levied on the goods and services we use. What is HS Code. The Tax Code List window appears.

Ill help you understand the various tax codes in SQL Account to better equip you how y. Find GST HSN Codes with Tax Rates. The tax itself applies to essentially every product and service in Australia.

The procedure to find HS Code with tax rate is very simple. And yes Salary ie services by an employee to the employer in the course of or in relation to his employment is one of them. Under this tax slab 18 tax is levied on the goods and services we use.

Under this tax slab 5 tax is levied on the goods and services we use. Attend our GST webinar to help you to understand GST and its implications for business. Under Import GST Deferment Scheme IGDS approved GST-registered businesses pay GST on imports payments when their monthly GST returns are due instead of at the point of importation.

Salary for services like accounting IT human resource provided by the head office of a company to its branch offices in other states will attract 18 per cent GST. GST rates for all HS codes. The GST amount on property sales may be calculated on the full value of the sale or on the margin for the sale.

Complete the other fields in this window. Only a small number of activities are excluded from the scope of GST. MYOB has an extensive list of codes that can be used in a variety of situationsfor example when doing business with overseas customers when tracking capital.

To create a tax code. Sales of goods and services in the course of your business or enterprise ie trading stock. Betting and casino taxes.

Customs and excise duty. Under this tax slab 0 tax is levied on the goods or services we use. You can use 4 digit HS code to generate your invoices.

You can search GST tax rate for all products in this search box. You have to only type name or few. In order to understand the GST codes you must first understand what GST is.

Type of Supply GST code. ThinkStock Photos Although the GST charged on such supplies can be claimed as input tax credit ITC companies which are exempt from GST will not be able to claim credit. All around the world same HS codes are used to discribe a product.

GST is not applicable on salary received from employer. A 4-digit HSN code is to be mentioned by taxpayers with a turnover of less than Rs5 crore. Goods and Services Tax.

The Goods and Services Tax or GST is a 10 tax that is placed on many items and products across Australia. SAC Code For Payroll Services as below. If you have incurred the expenses as an agent.

In the Tax Code field type a code up to three characters for the new tax and press Tab.

File Manager In Eztax In App Filing Taxes Income Tax Self

Aiat Gst Suvidha Kendra Income Tax Return Tax Return Income Tax

Income Tax Gst Compliance Calendar For June 2022

Bill Of Supply Invoice For Composition Microsoft Word Invoice Template Invoice Template Word Invoice Design

Best Photos Of Microsoft Invoice Template Free Invoice Template Simple Invoice Template Photography Invoice Template Invoice Template Word Photography Invoice

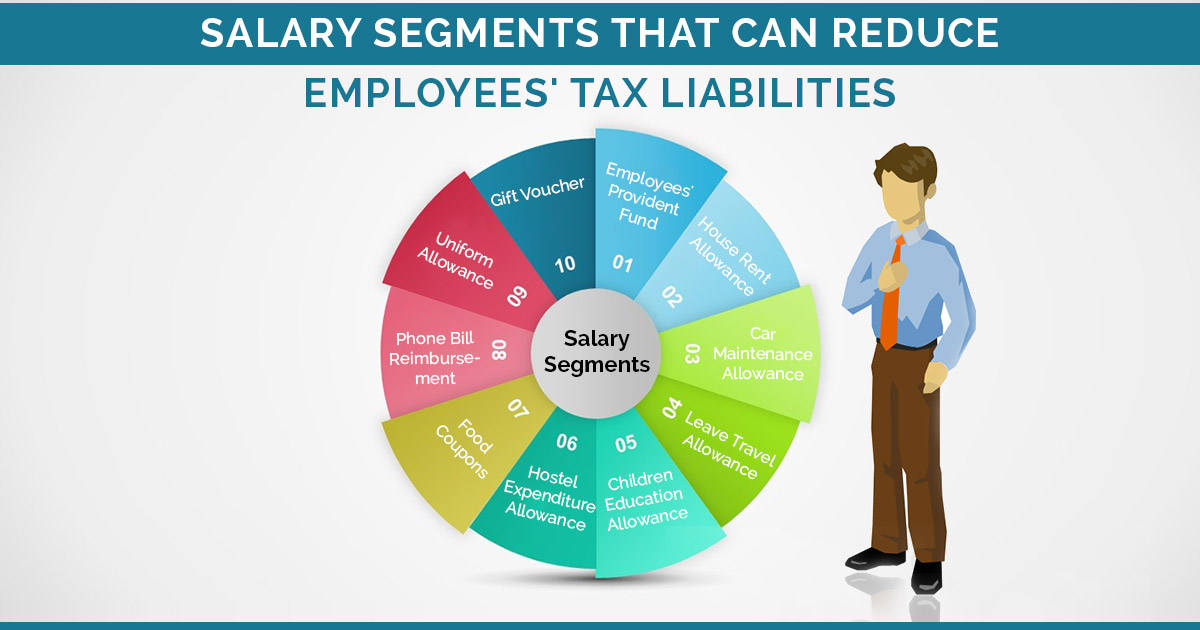

Salary Segments That Can Reduce Employees Tax Liabilities Sag Infotech

Watch This Video Here Http Www Youtube Com Watch V Wsvfcomdrcq Fast Track Income Salary

Pack Of 28 Salary Slip Templates Payslips In 1 Click Word Excel Samples Payroll Template Resume Template Free Job Letter

Easy Difference Between Direct

How Is Professional Tax Deducted From Our Salary Vakilsearch

Income Tax Rate On Private Limited Company Fy 2021 22 Ay 2022 23

Must Know Important Things On Gst Payment For Freelancers Freelance Goods And Service Tax Payment

Income Tax Calculator Python Income Tax Income Tax

Income Tax On Salary And Filing Salary Returns Indiafilings

Employee Salary Slip Format Salary Slip Format In Excel Download Free Salary Excel Masters In Business Administration

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)